Privately owned business interests can complicate estate planning, often requiring an independent, outside professional to help determine business value to comport with IRS filing requirements. Even without privately owned business interests, estate planning can be a complex process that requires individuals to consider current tax laws, family dynamics, and the size of the estate as well as the circumstances of the business and its owners.

Privately owned business interests can complicate estate planning, often requiring an independent, outside professional to help determine business value to comport with IRS filing requirements. Even without privately owned business interests, estate planning can be a complex process that requires individuals to consider current tax laws, family dynamics, and the size of the estate as well as the circumstances of the business and its owners.

However, taking certain steps and reviewing certain factors can help individuals ease the estate-planning process.

Personal Balance Sheets and Appraisals

To start the estate-planning process, individuals can create a personal balance sheet by determining which assets are easy to value and which require an independent appraisal. In the absence of formal appraisals, owners can look to tax-assessed values or opinions from brokers to establish preliminary values.

Business interests, which are harder to value, can make it more challenging to equally or fairly divide assets between heirs. This is because individuals need to determine which assets are personally held and which are part of a business structure before they can be assigned to an heir.

Appraisal Methodology

There are typically three approaches that business appraisers use to value a privately held business interest:

- Income Approach. In this approach, estimated future returns are discounted to present value at an appropriate rate of return for the investment.

- Market Approach. This approach utilizes valuation ratios derived from market transactions involving companies that are similar to the subject business. Past transactions involving the subject business, if any, are also considered.

- Asset-Based Approach. In this approach, the assets and liabilities of the business are restated from historical cost to fair market value.

Appraisers can also apply different valuation methodologies based on whether the interest is an operating- or holding-company interest. It’s also important to consider future prospects for a business including potential capital reinvestment needed to support growth.

Relocate Assets

If an individual has a sole proprietorship or holds a large portfolio of real estate or marketable securities, it may be beneficial to move these assets into a business structure. Commonly used family business structures include limited liability companies and limited partnerships that offer benefits such as asset protection and maintaining asset control.

Buy-Sell Agreements

Putting a buy-sell agreement in place for an operating company can be an important step in the estate-planning process. Limited liability agreements and limited partnership agreements for family businesses often include provisions limiting the transfer or sale to nonfamily members.

These restrictions create a mechanism for keeping interests within the family, while allowing business appraisers to apply discounts for lack of control and marketability. However, buy-sell agreements are often overlooked in operating companies because founders typically don’t consider transferring the business when agreements are originally put in place.

Estate Taxes

Noncontrolling interest discounts that arise from operating or buy-sell agreements can be helpful for individuals who are approaching federal or state estate-tax exemption levels. They can also help individuals transfer assets to family members prior to death because the current federal lifetime gift exemption is shared with the federal tax exemption. This allows lifetime gifts to be deducted from the federal estate-tax exemption at death. While the current federal exemption is $11.4 million per individual, state exemptions vary and may affect tax planning.

Estate-Tax Levies

Twelve states and the District of Columbia currently levy an estate tax. Six additional states have some form of inheritance tax that shifts the tax burden to the recipient of the inherited property.

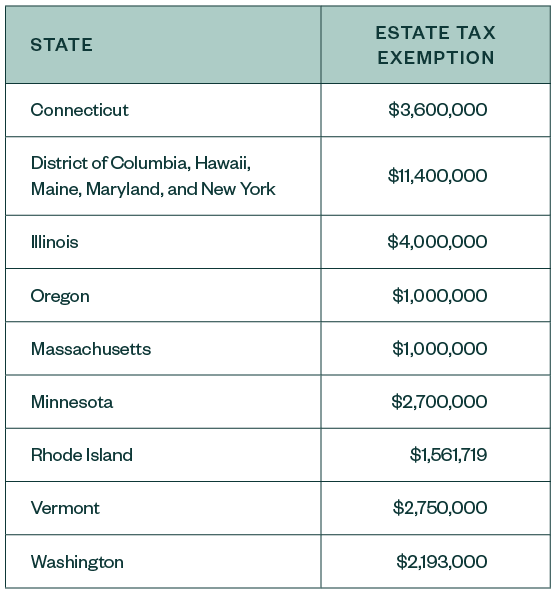

The table below demonstrates how many states choose to mirror the state-tax exemption threshold with the current federal estate-tax exemption level of $11.4 million. However, those states with lower estate-tax exemptions create estate planning challenges.

Private Equity Discounts

When appraising business interests in this context, the subject interests are often non-controlling ownership positions. According to fair-market-value standards used by the IRS in this setting, the size, rights, and restrictions on a business interest affect its value. To determine value and reveal appropriate discounts, appraisers can use various market indications and academic studies. These discounts should be applied to private business interests to account for lack of control and marketability.

Lack of control and lack of marketability discounts vary widely. However, some factors affecting discounts are within the control of the interest holder. Generally, the following factors apply:

- The more illiquid an asset, the higher the applicable discount

- The higher the risk or volatility of an asset value, the higher the applicable discount

Factors to consider when determining a business interest’s marketability include the following:

- Access to information

- Buy-sell agreements or other transfer restrictions

- Call-redemption or put rights

- Degree of voting power

- Universe of potential purchasers

- Volatility of stock price or asset value

- Dividend or distribution prospects

- Profitability and solvency of the company

Next Steps

To comply with IRS adequate-disclosure rules regarding transfers of business interests, estate owners can benefit from having a current valuation report that’s effective within three months of the date of the gift or transfer. Many donors often make gifts effective on December 31 or January 1 using a single appraisal report to make planning more fee-efficient.

If estate planners opt to sell for cash or a note to a family member rather than donate a direct gift, it’s still important to have a contemporaneous appraisal of such business interest and file a no-tax gift return to start the three-year statute of limitations during which the IRS can review and challenge the value of the gift or sale.

Current tax laws will likely affect estate planning, so any past or current plans should be revisited in light of tax law changes. To learn more about the tax reform reconciliation act of 2017, commonly referred to as the Tax Cuts and Jobs Act, read our Insight.

We’re Here to Help

For more information on estate planning or to start a valuation report, contact your Moss Adams professional.